TAX-FREE INVESTMENT ACCOUNT

The TFSA is a very unique portfolio, we are adamant that EVERY South African should be invested in this portfolio. You will never be taxed on any capital growth, dividends received, interest received, or trading profits within this portfolio. It is truly totally tax-free!

As proposed by SA Government Treasury in 2015 the proposed Tax-Free Savings Accounts or TFSA came into being. It was officially launched on 1 March 2015, has been designed to encourage people to save money by offering tax savings as an incentive. Under the new legislation, any South-African Citizen will be able to invest a maximum of R 36 000 per year (it started with R30 000 in 2015, was then increased to R33 000 in 2017, and has been increased again in 2020 to R36 000), with a lifetime contribution limit of R 500 000. All gains made on the investment including capital gains, interest payments, dividend payments and any additional income derived from the investment are free from any form of taxation. This is TAX-FREE for as long as you live!

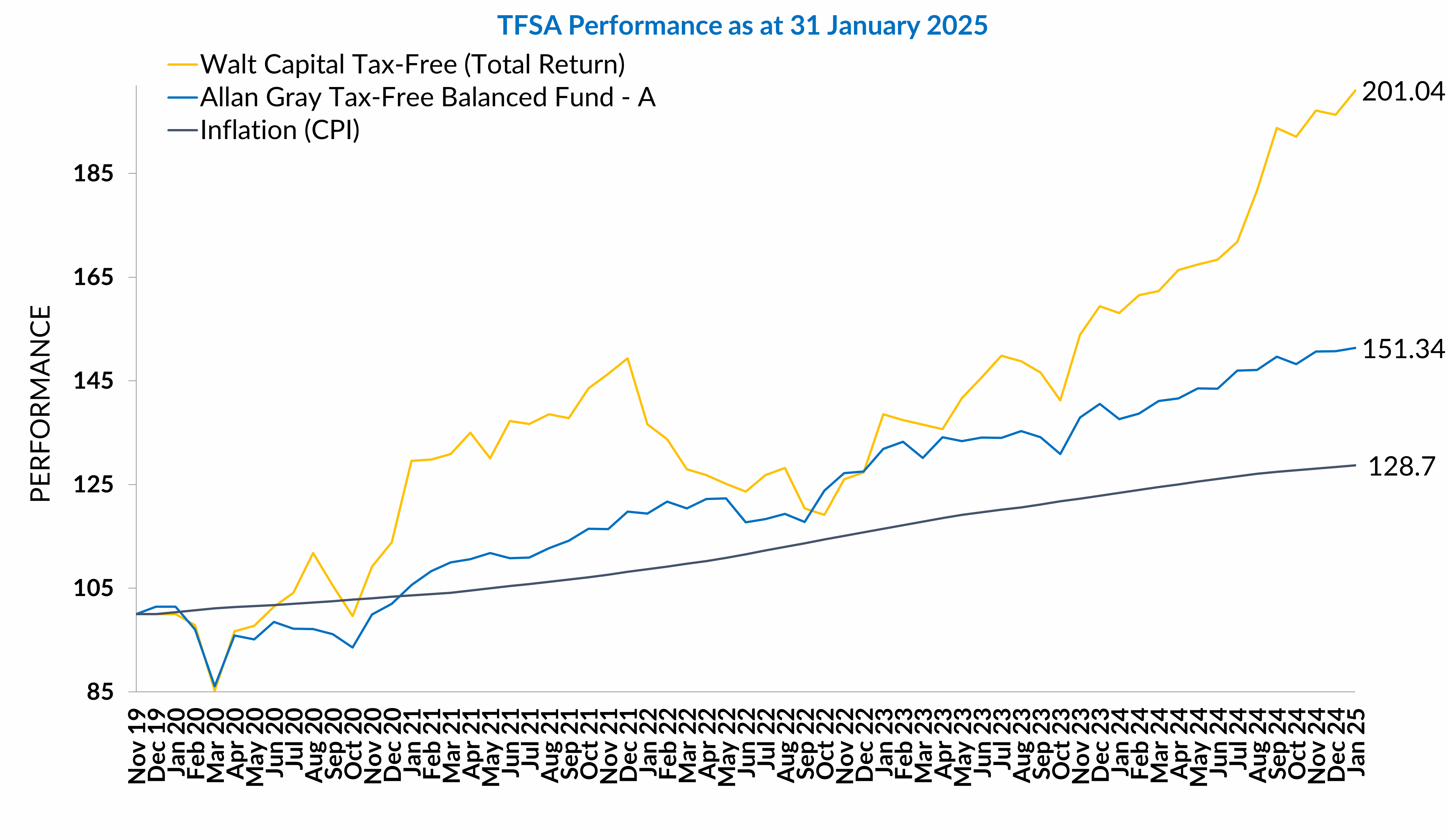

The tax-free savings plan should be viewed as a long-term investment, as the benefits of the tax-free gains and income will begin to increase exponentially as the effects of compounding take effect.

For example, a TFSA started for a baby today should grow to around R20m over the next 60 years…. that is R20m in today’s money! This investor will be able to benefit from a very long time horizon, (20 – 60 years) where the tax savings will make an enormous difference to future wealth.

As a longer-term savings and investment vehicle, the TFSA, compliments your current financial planning and investment objectives. The possibility of drawing a tax free income later in life, or withdrawing tax free amounts to pay down debts, pay university fees, or travel, with no restrictions on the timing or amounts, makes a TFSA a great addition to any investment plan.

Example: Mr. and Mrs. Joe Soap are 35 years old; both save their maximum allowance and keep their investments till age 65. Assuming an inflation rate of 6% and an investment return of 12% per annum, (which will include growth, interest, and dividends – there is NO dividend tax in the TFSA-), their combined capital amount at age 65 would be R 14 236 258. (Calculated at a fixed rate of R33 000 per year, inflation-adjusted. (Increases to the limit will change the final amount.) Depending on tax rates, more than a million rand can be gained from CGT savings alone. It is a free lunch that investors just cannot miss! Contact us now to discuss this amazing product!